- TOOLUSE CASE

- Popular Categories

- Pricing

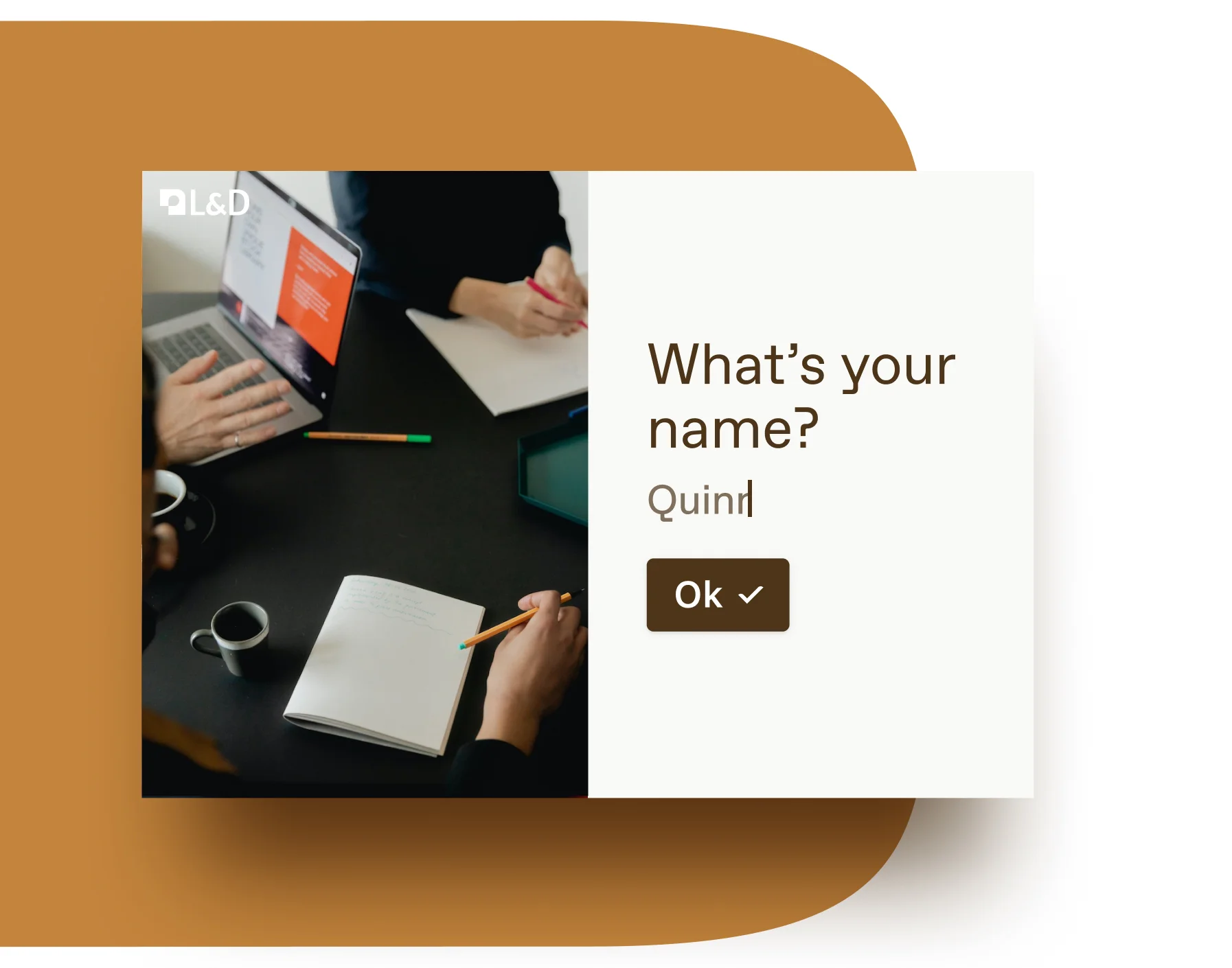

You’ve taken one. Now make one.

Whether your goal is signups, feedback, or something else, you're in the right place. Make forms designed to get more data—like the one you just filled out.

Get more with Typeform

Get more with Typeform

More signups

Grow your audience with striking forms designed to help you stand out, so more people sign up for what you sell.

More ideas

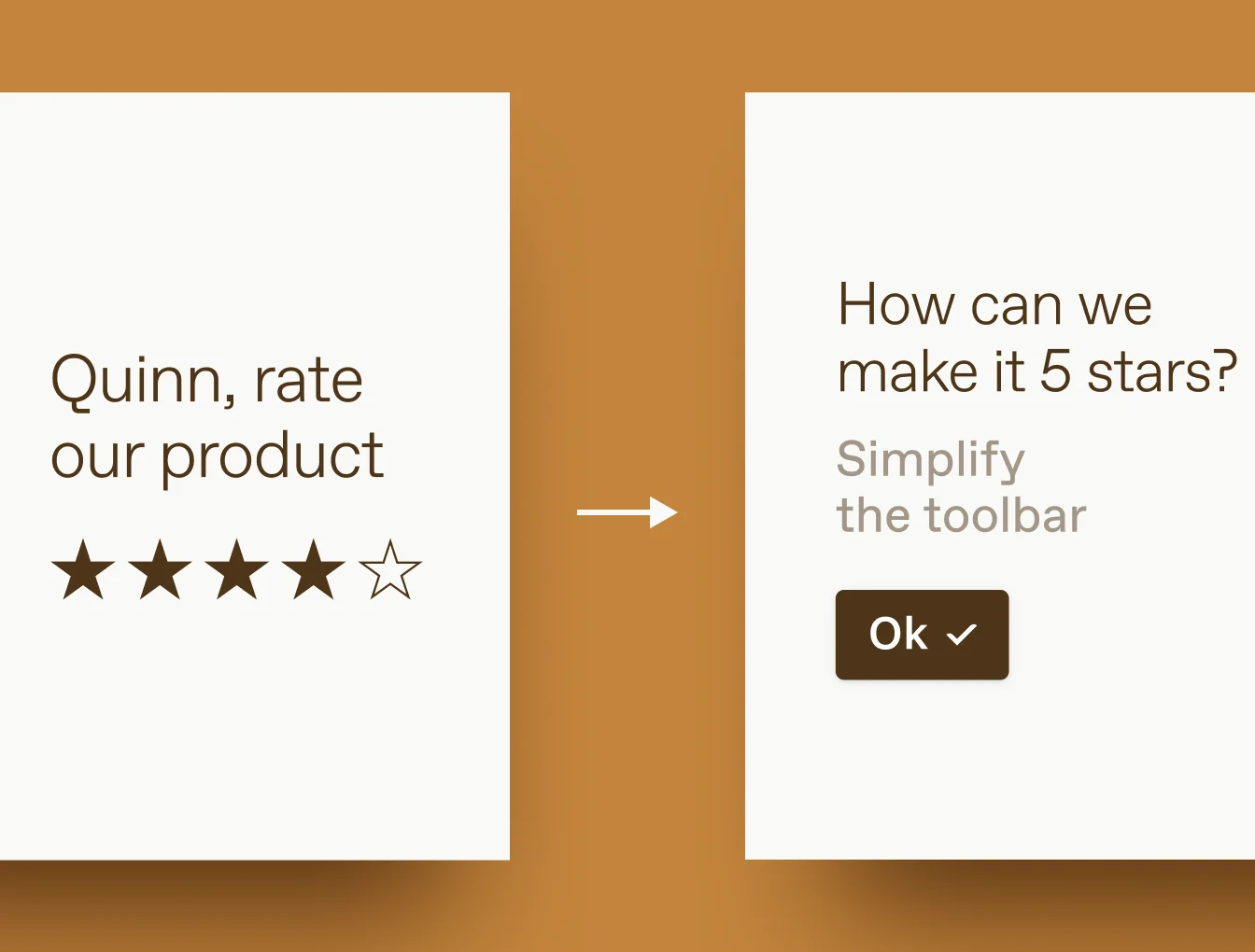

Improve your business with feedback forms that help you get deeper insights by encouraging people to elaborate.

More certainty

Gain confidence with market research forms that help you validate ideas, so you can make more informed decisions.

Why choose Typeform?

Why choose Typeform?

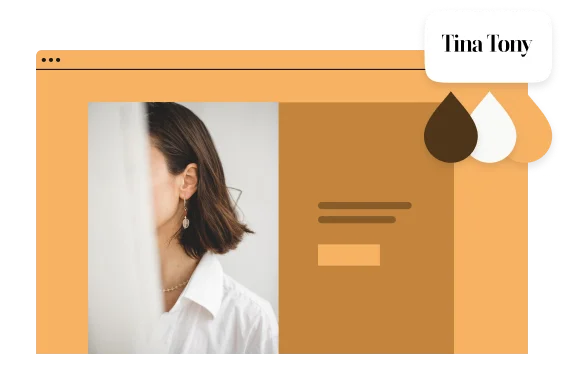

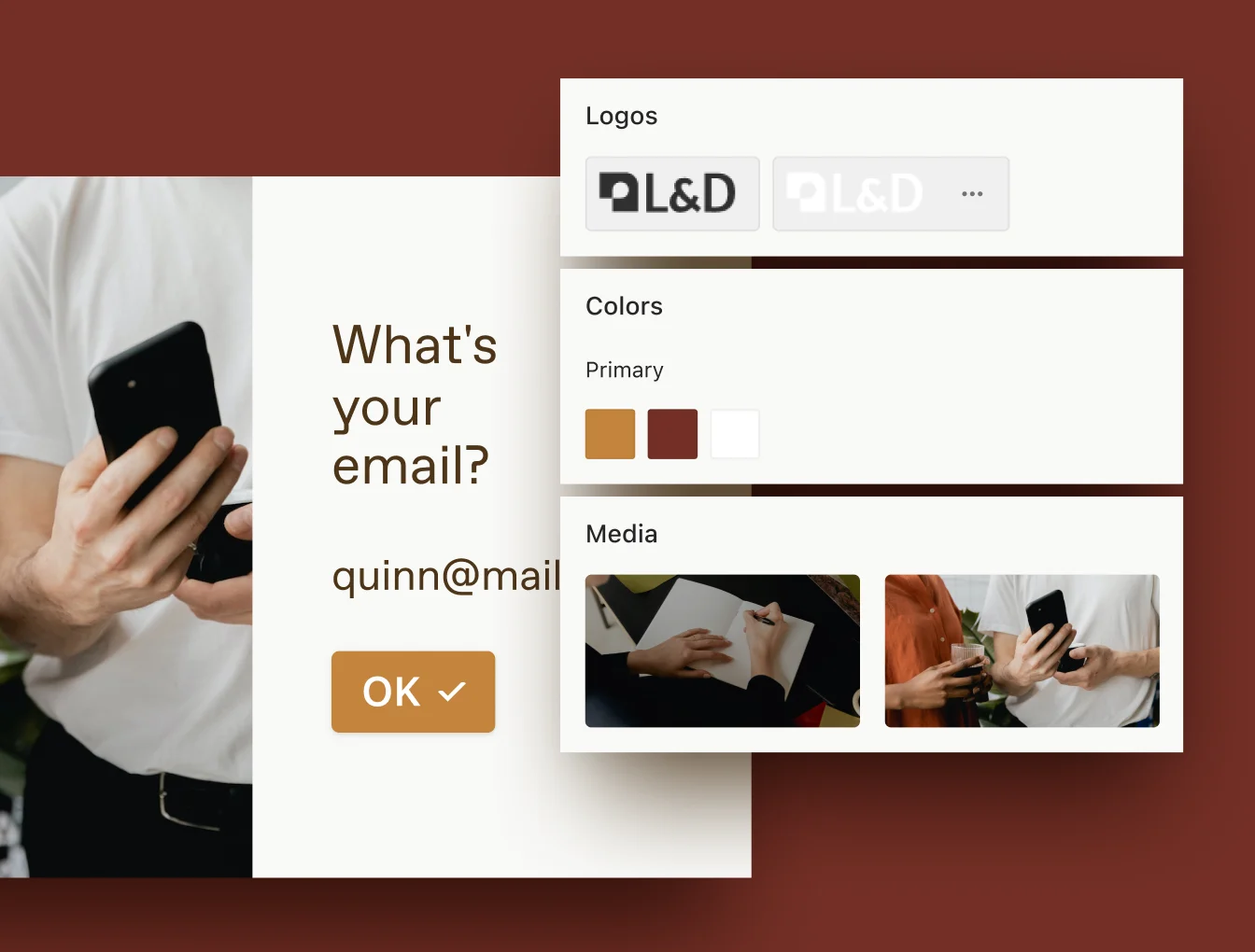

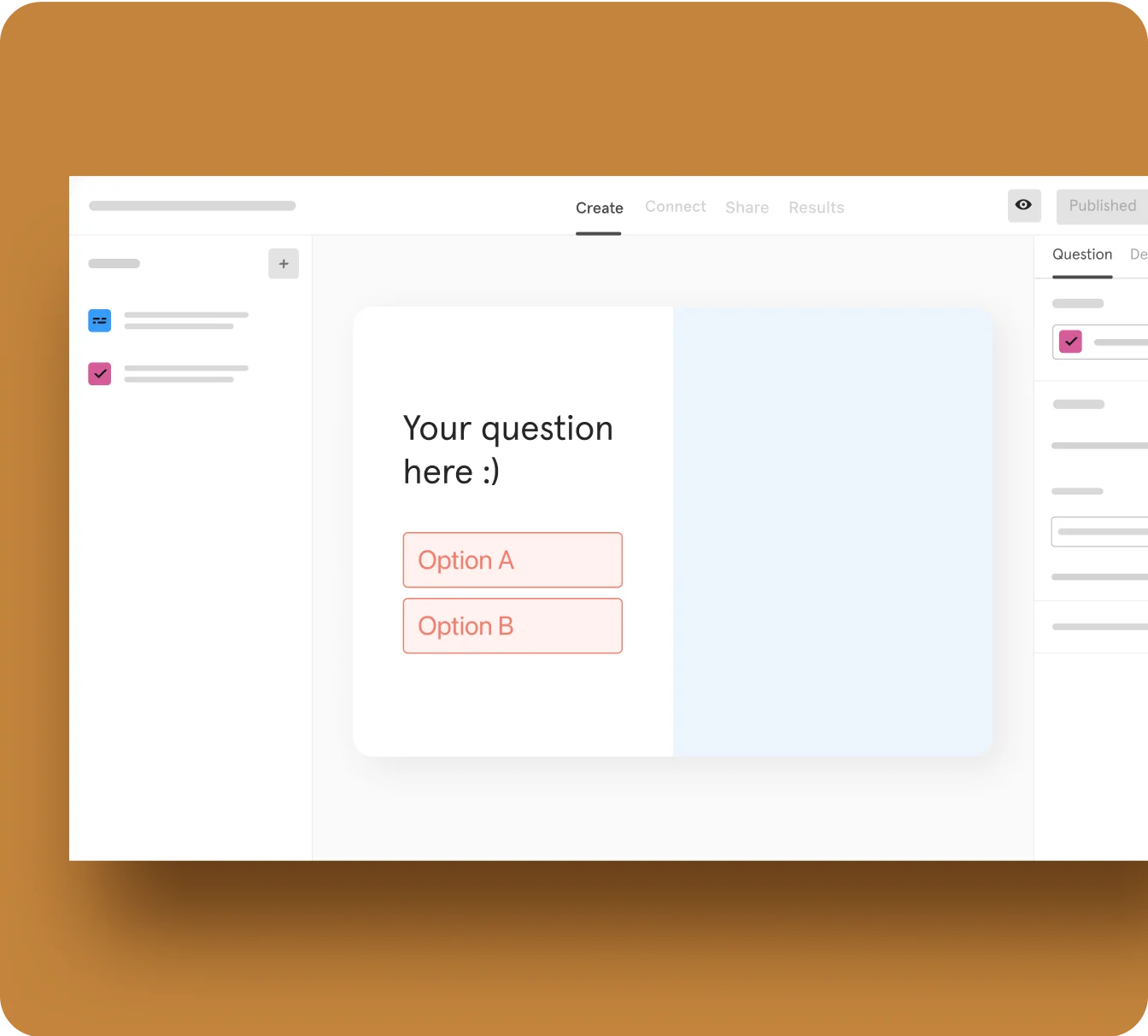

Makes data collection less dizzying

Use templates and 20+ question types to structure your form, then customize the look and feel to match your brand.

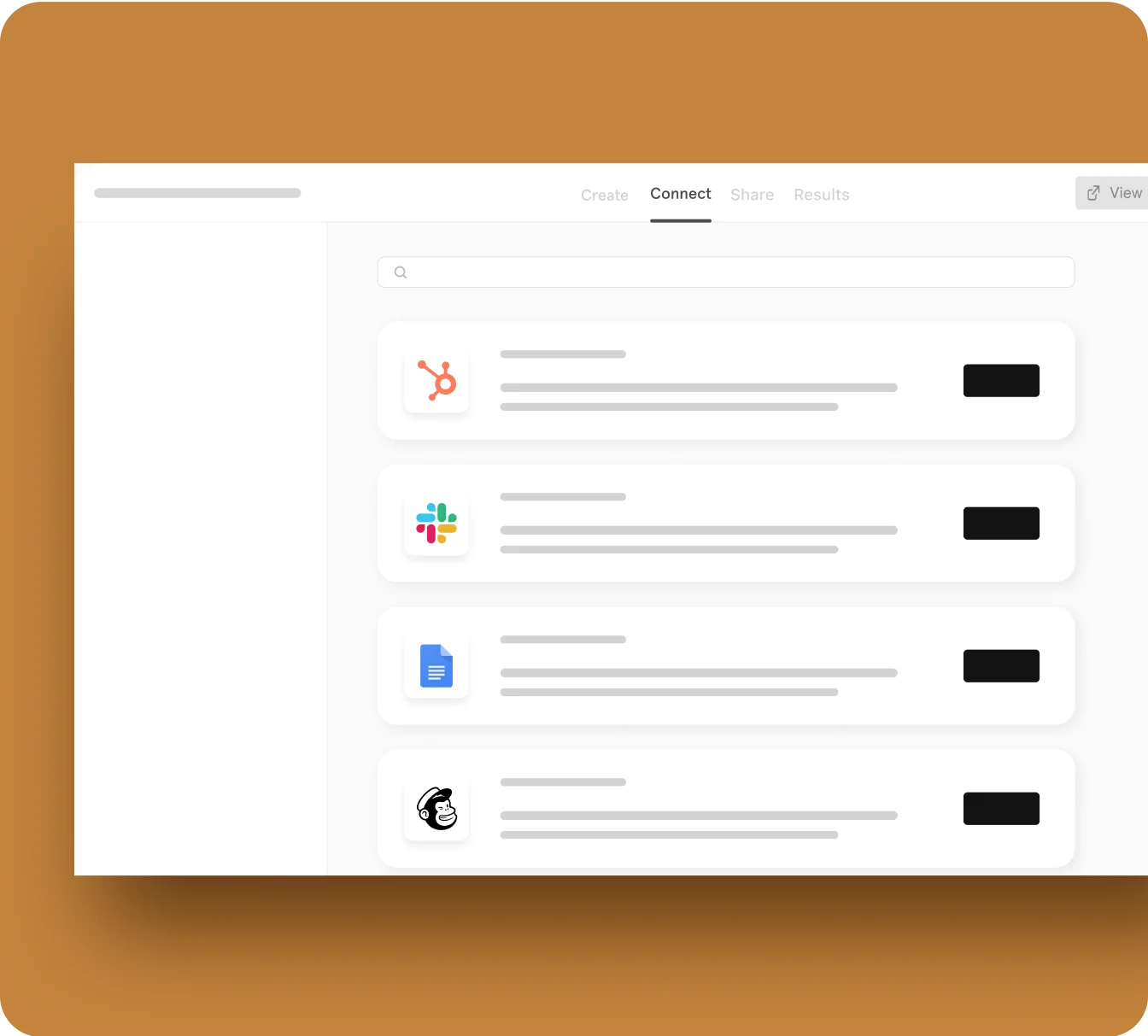

Integrate your favorite apps with your form, so you can save time and do more with your data.

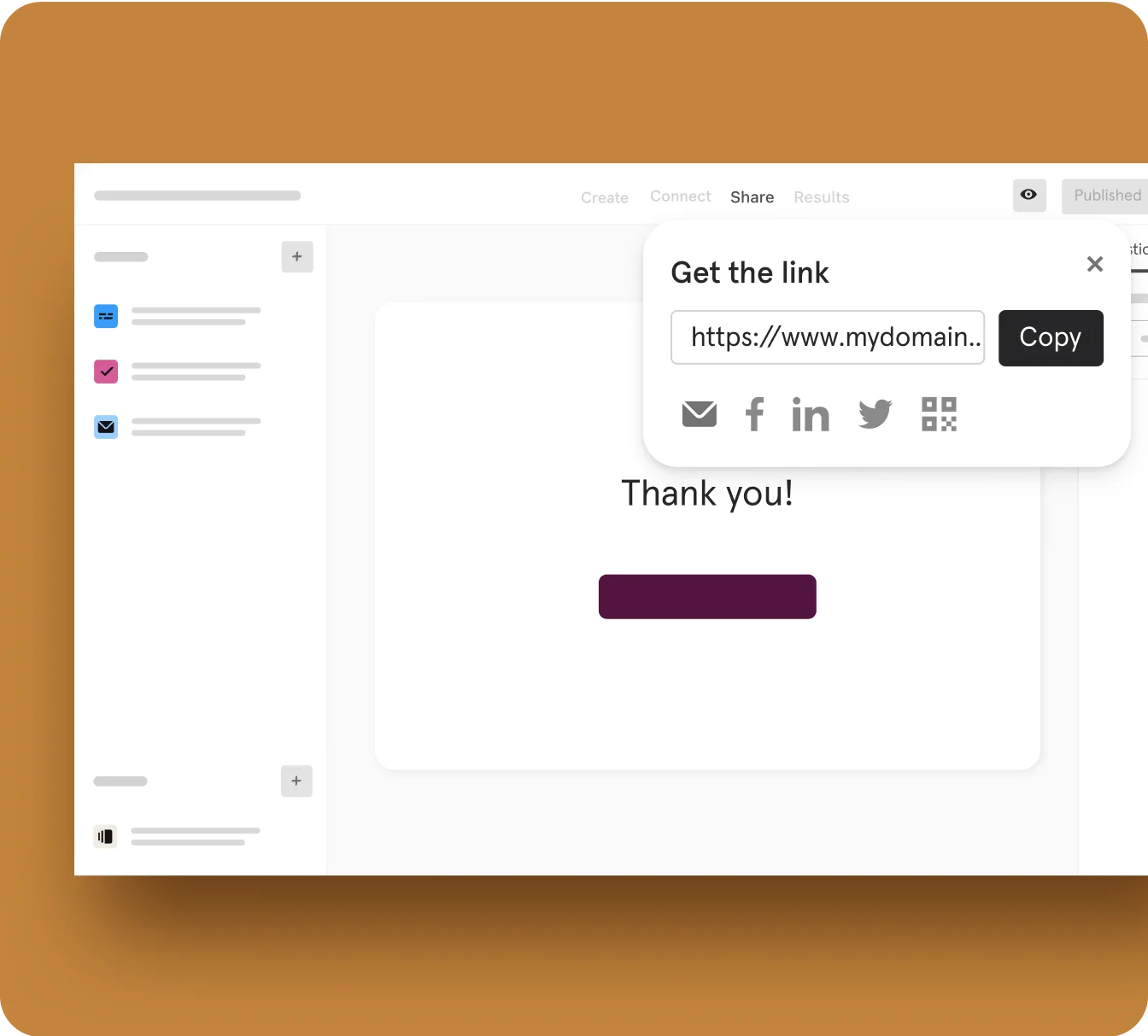

Get a link to share your form on social channels, or copy ready-made code to embed it in emails and landing pages.

See how many people have filled out your form and see which questions could be performing better.

Works with your existing workflow

Zapier

Google Sheets

Slack

Google Analytics

Hubspot

Salesforce

Loved by professionals like you

Cara Harshman, Amplitude

We’re getting fantastic results

Johnny Rodgers, Slack

Was blown away by the UX

Will Allen-Mersh, Spill

Not magic, but it's pretty close

Not yet ready to try Typeform?

Sign up for our newsletter to find out what Typeform can do for your business.

Discover what Typeform can do for you, for free

Discover what Typeform can do for you, for free

Our Free Plan lets you:

Create unlimited forms

Access 3,000+ templates

Publish and get responses (10/month)